Savannah Petroleum provides fresh Seven Energy transaction and corporate update

Savannah Petroleum, the British independent oil & gas company focused around activities in Niger and Nigeria, has provided a corporate and operational update as well as an update on the Seven Energy Transaction.

Seven Energy Transaction Update

Savannah has announced that the UERL Buy-Out, as referenced in the Company’s RNS of 20 September 2018 has been completed. The Seven Energy Group now owns 100% of UERL, the entity which holds a 51% operated participating interest in the Stubb Creek field. The Buy-Out saw the acquisition by the Seven Energy Group of the 37.5% minority shareholders in UERL, in return for total cash consideration of c.US$3m.

Good progress continues to be made on other Transaction workstreams, including the expected granting of Ministerial Consent, and agreeing and finalising long-form documentation in relation to the AIIM Investments, the Accugas debt restructuring and the Frontier Swap.

The Company continues to expect that the Transaction will complete during Q2 2019, which will be followed in due course by the publication of a Supplemental Admission Document. Further updates in relation to the Transaction will be published as appropriate.

Prior to the completion of the Seven Energy Transaction and the commencement of production from the Niger early production scheme (‘EPS’), Savannah remains in the pre-revenue stage of development and at a point where the Board believes it is inappropriate to consider the payment of a dividend.

Following the expected completion of the Seven Energy Transaction, the Company expects to consider the commencement of shareholder returns (either by way of a dividend payment and/or share buybacks) in respect of 2019.

Seven Energy Operational Update

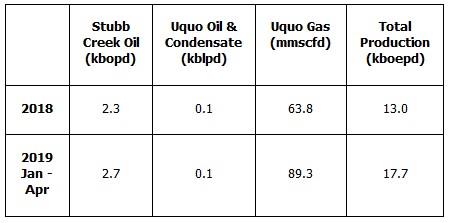

Average gross daily production from the Seven Assets for the 2018 and 2019 year to date periods is shown in the table below. Gas from the Uquo field is sold via Accugas to three principal customers through gas sales agreements (“GSAs”), with gross take-or-pay volumes under the GSAs set at 152 mmscfd (25.3 kboepd).

Oil and condensate production from the Uquo and Stubb Creek Fields is transported via ExxonMobil’s Qua Iboe oil export terminal and is sold under a crude offtake agreement with MPN (a subsidiary of ExxonMobil).

As previously announced, production during 2018 was impacted by an ongoing maintenance programme at the Calabar National Integrated Power Plant (“Calabar NIPP”), one of Accugas’ three principal gas customers. The maintenance programme is now complete and production is expected to continue to ramp up over the course of 2019.

Niger Operational Update

Savannah expects to proceed with its planned Amdigh-1 well test in 2H 2019, following the expected completion of the Seven Energy Transaction.

The Company’s previously announced Pre-Stack Depth Migration (‘PSDM’) seismic processing project on R3 East has now completed. The PSDM dataset shows an overall improvement in seismic imaging (better event continuity and fault definition) at all levels vs. the existing Pre-Stack Time Migration (‘PSTM’) dataset.

The interpretation phase, which is planned to start in June, will assist in confirming drilling targets to support the proposed EPS as well as identifying additional prospectivity in the deeper Yogou and Donga Cretaceous intervals.

Source: Savannah Petroleum