-By Professor Omowunmi O. Iledare

PREAMBLE:

The Constitution of Nigeria empowers the Nigeria National Assembly to prescribe laws in such a manner as to optimally manage oil and gas resources in Nigeria. Thus, the Host Community Development Chapter in the 2020 PIB is an appropriate step in the right direction. Events of the last three decades, since 1995 to be precise, have made managing petroleum resources in Nigeria for value creation extremely difficult. The severe economic consequences to all stakeholders are evident. Unfortunately, it has been rather very unpleasant that the idea to make Petroleum Host Communities significant stakeholders continue to remain elusive. Perhaps, the elusiveness is easily attributable to transactional leadership style at the State, Federal and Community level; elite capture mentality of citizens at large; the pervasive Esau’s syndrome in the petroleum host community; and the collapse of the national value system.

Notwithstanding the current state of things alluded to above, PIB 2020 offers the opportunity to end the perceptions of neglect, inequity and abandonment, which are the bedrock of sustained agitations in the region by the host communities. There are the general feelings of inequitable remunerations to ameliorate the direct negative social and pecuniary impact of petroleum operations in the region. There is a sentimentality of exclusion from the ownership and direct rewards as reflected in the CFRN 1999, which vested the ownership rights of hydrocarbons and minerals to the Federation. The departure from the Revenue Sharing (minerals) framework under the 1963 Republican Constitution – 50% derivation, 20% FGN, 30% paid into the distributable pool, shared among the states, including the Donor States–continues to agitate the minds of resident inhabitants from generation to generation. In addition, the perennial feelings of lack of sufficient economic development arising from the proceeds of oil and gas production operations proliferate in the region. Are these perceptions conjectural or tangible?

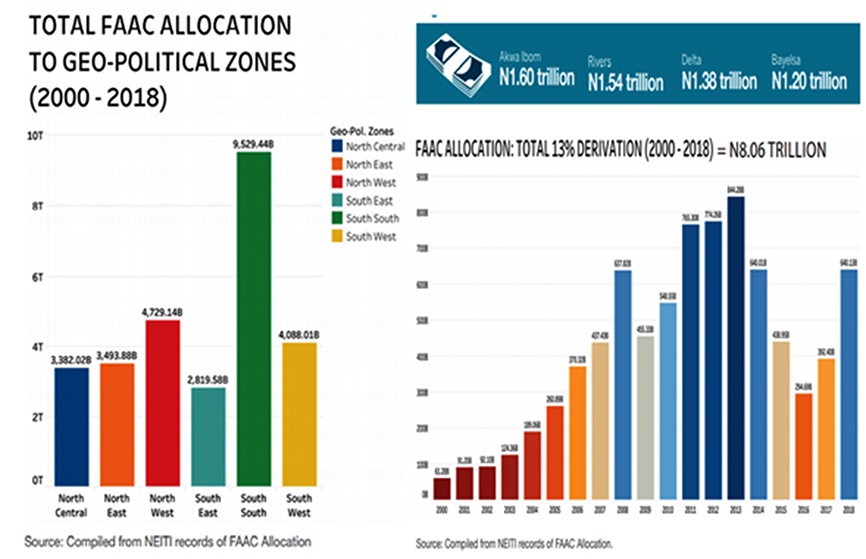

Empirical evidence tends to suggest that these perceptions are plausible even though the Federation has attempted, severally, to address or ameliorate them. Figure 1 shows that the Nigeria Federation through its Federal Government has attempted to diffuse agitations in the community using fiscal instruments such resources from 13% Derivation and NDDC Act etc. These resources conferred to the State governments to care for host communities hardly trickle down to the petroleum community in a large enough quantity to make the type of difference required in transforming the region.

Unfortunately, community agitations and its unintended consequences continued unabated, including loss of production days due to sabotage; crude theft and environmental damages in the process; revenue losses to all stakeholders; militarization of petroleum operations, criminality and destruction of assets, and subsequent investment flights to other petroleum jurisdiction and perpetuating more poverty in the region. All of the above informed the provisions in the third Chapter of the 2020 PIB following the footstep of the Petroleum Host Community Bill 2018 that did not see the light of day.

HOST COMMUNITY DEVELOPMENT PROVISIONS

The third chapter of the 2020 PIB has 24 provisions or sections on the development of host communities. The aim is to provide sustainable prosperity in the region while keeping abreast the intergenerational implications of exhaustible hydrocarbon extraction.

OBJECTS OF THE PROVISIONS

The objectives of the provisions include but not limited to fostering sustainable prosperity in the communities; providing commensurate benefits from petroleum operations in the communities to ameliorate operational externality; guaranteeing peaceful and harmonious coexistence of stakeholders in the communities; and creating a framework to sustain economic and social development in petroleum host community. Regulations to ensure that the pursuant of these laudable objectives stands the test of time, rested on the Commission and the Authority, accordingly. These responsibilities are as specified in Chapter I of the PIB 2020.

FUND UTILISATION:

PIB 2020 puts all of the above into consideration while developing the Host Community Development Provisions. There is a very clear specification of how to use the fund in the Bill. Empirical evidence suggests host community provisions are essential for petroleum sustainability in the Niger Delta. The effective implementation of the provisions on host communities in chapter three is critical to support the drive to reduce costs of operations and minimize investments flight to other jurisdictions as well. Reducing direct and indirect security costs and minimizing revenue losses to all the stakeholders as earlier mentioned are key to sustainable oil and gas development in a competitive and attractive manner. This is so essential for sustainable economic development of Nigeria. Not to mention how important is getting the provisions in the Chapter correct.

The provisions in PIB 2020 on the modality for fund utilization represent a great departure from the NDDC Act as well as the 13% derivation allocation to the Oil Producing States, which has no utilisation guide. Section 236 (6) empowers the Commission or the Authority to make regulations to safeguard the utilization of the trust fund with oversight responsibility in terms of effective project implementations in the region. In addition, Section 241 stipulates matters on which the funds may be applied, putting emphasis on the existence of approved development plans by the community for the community. This provision states emphatically that the approved plan must be constitutional in order to get funding approval by the Board of Trustees even if the management committee directs the funding of the plan. The plan is not an imposition by the trustee; hence, the community is the driver of the plan.

Section 244 (b) is innovative catering futuristically to a known fact that Settlors and funds are not perpetual. The mandate to invest at least 20% of the trust fund for future projects is quite admirable, representing another departure from the NDDC Act and the derivation fund paid to the state and used mostly for state operating expenditures. I must say that some clarity is in order because there is no clear definition in the Chapter of legitimate host petroleum communities. Perhaps, the settlors through communities needs assessment can easily define the host community as a community situated in its area of operations, around the pipeline right of ways, and any other facilities as the settlor may determine. I wonder if the unilateral designation by settlor of who is an impacted host community from its operations may lead to court cases if a community perceived abandonment or exclusion.

SOURCES OF HOST COMMUNITIES TRUST FUND

Section 240 (2) prescribed 2.5% of Settlors actual operating expenditures in the immediately preceding the calendar year. Without mincing words, the idea of Host Communities Development funding is innovative, conceptually sound and homegrown. Perhaps it would provide a way to minimize agitations and disruptions. However, while it is true that one road does not lead to the market, there is one road with an optimal travel path to the market. I hasten to say that 2,5 % of OPEX to fund a sustainable host communities development path does not do justice.

Certainly, there may be neutrality in terms of the impact on government take and investment performance, the paucity of the ensuing funding seems window dressing. The estimated fund is about N10 – 14b (upstream only) going into the funds annually. This will be grossly inadequate given the number of communities, terrain and development deficits. Strategic thinking would support that funding provisions should ensure materiality of funds for impact especially for communities with midstream assets. The degree of vulnerability, if OPEX is the primary funding source, are astounding because of the heterogeneity of Settlors and variability of their operating expenses.

This is an opportunity to settle, finally, the hydrocarbons ownership issues. Moreover, I do not think 2.5% of OPEX provisions in PIB 2020 sends any signal of the seriousness of ownership exclusion perception that fuels agitations in the first place. Paying a portion of royalty to host community, especially the affected communities, reflects a reward for ownership, than all the instruments employed so far. A visitation on the NDDC Act to surrender a portion to operationally affected communities trust is worthy of consideration. The derivation provision in the constitution beyond the 13% is due for amendment and a prescription of a spending modality rather than just passing it on to the State and Local Government is inevitable now too.

CONCLUDING REMARKS

Every attempt to resolve agitations in the Niger Delta has remained elusive, since the 1970s, and seems to have failed. Derivation fund did not stop the agitation, amnesty as a program has not arrested the unrest, neither has NDDC Act nor the Ministry of Niger Delta. Empirical evidence suggests these instruments had affected negatively the host community than the derived benefits. Of course, these instruments have created more millionaires in the Niger Delta but with no noticeable benefits to the petroleum host communities.

The proposed PIB 2020 funding provisions for development plans in host communities are not radical enough to address the “ownership and participation” question, effectively. Using a proportion of royalties even, if as another palliative measure, is worth consideration. I have heard people imposed the Constitution as a cover on this suggestion, but one more violation of a pseudo constitutional mandate may be worth it to save Nigeria from economic collapse. It is a good trouble to have and a necessary trouble for that matter. Luckily, there is a precedent to impose the doctrine of necessity to surrender a portion of the royalty to develop the region for posterity. It is far better to use royalty than the equity participation option in consideration. The Indorama Eleme Petrochemicals experience is not an applicable model because of the heterogeneity of the region and the amount of money involved, apart from the unpredictability of equity rewards. I smell the rat, called ‘elite capture syndrome’ taking advantage of stomach infrastructure deficiency. Nigeria is no longer the bride in the Gulf of Guinea investment destinations.

Finally, I think it is important to streamline all other interventions (State, MNDA, NNDC, etc) to ensure clarity of focus and integrated/sustainable development to make funding provisions to ensure materiality for impact. Finally, equity participation in upstream investment as a way to palliate the host community is a destructive transfer payment mechanism that does not translate to the fight for ownership of resources in my opinion. The millionaires in Nigeria with no value added to the overall economic output is a good lesson to learn in this regard!