The Federal Capital Development Authority (FCDA), officially saddled with the responsibility of developing and maintaining structures in the Federal Capital Territory (FCT) is set to commence its land swap scheme.

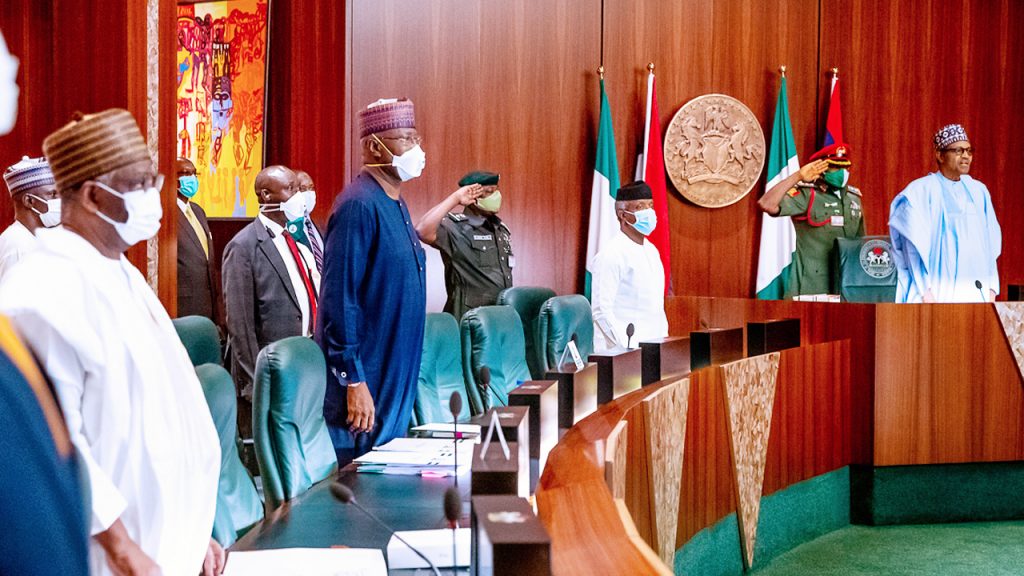

This follows the Federal Executive Council (FEC) approval for the resumption of the FCDA land swap initiative.

However, even though some estate developers and valuers are of the opinion that years of suspension have cast a doubt on the programme, and devaluation of the naira will escalate the cost of infrastructure, many also believe that a new start will boost housing delivery, and attract foreign investors.

The initiative, worth about N1 trillion, commenced under Senator Bala Mohammed-led administration, as the FCT was specifically designed to remedy the infrastructure deficit in the federal capital through swapping lands with private investors, who would, in turn, provide the necessary infrastructure.

Under the scheme, greenfield lands are granted to real estate developers who would provide infrastructure such as roads, electricity, potable water, drainages, sewer lines, and communication ducts to residents without any financial or technical demands on the government.

However, the programme suffered a setback after the National Assembly faulted the scheme, saying the initiative was a negation of the provisions of the original Abuja Master Plan, as well as a misplacement of priority in the direction of the physical development of the city.

The House of Representatives had argued that, if the programme was allowed to materialise, it would only succeed in creating development islands and brazen evidence of uncoordinated development.

Specifically, the land transaction began in 2014, and became controversial. The planned phases and pilot project, which were supposed to have commenced at Katampe District, were halted, after a registration fee of N350 million, each, according to reports then.

An estate surveyor and valuer, Musa Ibrahim, said the most critical factor that stalled the project was politics, accompanied by lack of finance. He said that, on the economic front, at the beginning, the minimum anticipated average investable cost to be borne by the investors per district was about N40 billion, each.

“On finance, imagine the volume of investible capital required, and ask whether our commercial banks can afford granting such facilities to investors to be recouped within a four-year tenor as envisaged by the contract,” he said.

He said investors took note of the political risks of the project in Nigeria, especially where transitions are likely, adding that the government had to take a second look at the project, because it was the Peoples Democratic Party (PDP) government that initiated it.

A member of the Real Estate Developers Association of Nigeria (REDAN), Malam Ahmed Goringo, said the land swap in FCT was coming a bit late – seven years after the project was initiated.

Explaining further, Goringo noted that the exchange rate was N150 to $1 at the time it started, when the FCT requested investors to pay a certain amount of money.

“We understand that three or more companies had paid their registration fee to move to sites. Today, one dollar is going for almost N500.

“So, it will be very costly for foreign investors to invest in the capital city. Whom are they going to sell the land to, because goods and services have gone up?

“At what value are they going to put the land now, because inflation has gone up, and equipment is needed to carry out infrastructure? Government should look into it before embarking on the exercise.

“The starting point matters a great deal. It could be profitable to the public, or for individuals. Therefore, stopping it halfway has become a serious issue. This means, we will start the exercise afresh. We hope there will be accountability and transparency.

“The Senate Committee on FCT stalled the exercise, after a public hearing. When the Committee conducted a check on all the processes, issues were raised. We thought the money spent was not accounted for when it was suspended. The good thing is that the President has approved the commencement of the project.

“The government has studied it and found out that land swap is a profitable venture, and it will reduce kidnapping and insecurity, as well as open up the capital city. People will rush to Abuja for land. The FCTA has done a good thing,” Goringo explained.

The Managing Director, System Property Development Consortium Limited, Sanni Zuwedu, while addressing the media, said property developers would benefit from the land swap, as it would attract foreign investors, and expand new horizons in the built industry, as well as offer mass housing to residents.

“The arrangement will move finance from the public to the private. You see, no investors gave any money. There were no sharp practices. It was only the transition from one administration that stalled the scheme. We had 26 firms identified as investors, but only seven signed the pact,” Zuwedu said.

The FCT Director of Lands, Adamu Jibrin, said the past government started the project.

“When we came, we set up a committee to study the whole exercise to make more inputs. We want to do it in the best interest of the government, real estate developers and the public.

“After that the committee made adjustments to correct the mistakes made. The idea is for developers to provide the infrastructure in the different districts, such as road networks, water, electricity and other amenities.

“The territory has sizable lands, and we are ready to offer districts or half of the district to interested developers, provided they fulfill certain criteria, such as bank bonds and capacity to move into sites for development. It will be a win-win situation,” he added.

According to him, the National Assembly investigated the previous land deal, and ordered a stoppage because of alleged irregularities. But now the government has realised the need to go into public private partnership arrangement to develop the land.

With the scheme said to kick start soon, many residents of the Federal Capital Territory (FCT), as well as investors are waiting to see how it pans out.