-By Prof. Omowunmi O. Iledare

Background:

The challenges facing the petroleum industry in Nigeria in the last ten years include, but not limited to: declining number of active rigs, declining number of producing wells, declining reserves additions, declining production, declining petroleum revenue, and declining contributions of the oil and gas industry to the economic output of Nigeria. The provisions describing the fiscal frameworks, if properly adjusted and negotiated in good faith, have the chance to accomplish the well-defined objectives as articulated in Section 258 of Chapter 4 of the 2020 Petroleum Industry Bill (PIB).

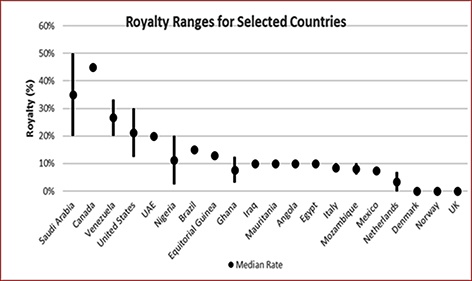

The charts below show why establishing a progressive fiscal framework that encourages investment, balances risked investment rewards appropriately, and enhancing government’s access to revenue is inevitable. Unquestionably, COVID-19 and the dynamism of energy transition have added new dimensions to render the fiscal framework outcomes that were envisaged when the PIB was originally initiated in 2000, and even at the time the PIB 2020 was submitted to the National Assembly in 2019. There seems to be a general consensus that the level of uncertainty regarding future crude oil demand is extraordinary, making investments for the optimal petroleum resource development business increasingly stochastic. There are some of us who subscribed to the fact that, if Nigeria is to overcome the peculiar challenges facing its oil and gas industry, a pragmatic fiscal reform is desirable – a reform that would forego the prosperity of the few today for prosperity of many in the future.

The premise that the usefulness of oil in the global energy supply mix has become a thingamajig in the negotiation process to facilitate the acceleration of petroleum exploitation in emerging petroleum countries, and by extension, matured basins like Nigeria. It is, therefore, notable that several amendments have been proposed since NASS public hearings on the PIB 2020. Stakeholders have been jostling to get one advantage or the other, not necessarily in direct negotiation with NASS. This action seems to me a reminiscence of what happened to the PIB 2008 with the interagency report tagged ‘IAT 2009’. I must, however, commend the 2019 NASS for the determination to stay the course and avoid the perception of being just a rubberstamp of the wishes and wants of the executive drafters of the 2020 PIB.

Of course, balancing prolific geologic prospects with adequate rewards for risked investments is an art and not a science. More so, when competition for capital investment in petroleum exploration and exploitation is keener than it was in the past years. There is no doubt that the world is still awash with petroleum and the world does not seem to be running out of it for some several more decades to come. Thus, optimising individual stakeholder’s interest to develop petroleum in Nigeria would depend quite interestingly on skillful negotiations of terms and conditions before the 2020 PIB becomes an Act by May 29, 2021 for political pragmatism. I must commend the executive team for the dedication and desire to get this bill passed once and for all.

The aim of this pedagogical on PIB 2020 fiscal framework, therefore, is to facilitate good understanding of some of the critical elements in the PIB, such as: royalty, the dual taxes, the incentives, and the arrangements, from a perspective of what ought to be rather than what is, in order to maximise stakeholders’ mutual interests. Let me say, without mincing words, that the design of the fiscal elements in the PIB 2020 follows the acceptable core principles and fiscal rules of general application. The clarity of the objectives and administrative mechanism are perceptible. Perhaps, the conjectural issues are the optimality conditions from the differing perspectives of stakeholders, majorly the community of investors. This is certainly understandable, making the balancing of stakeholders’ mutuality of interests critically important, if the Bill is to become an Act.

Provisions regarding classical fiscal system elements in PIB

Preamble: The Fourth Chapter of the original executive 2020 PIB to the National Assembly has about 50 provisions or sections plus 6 related schedules on petroleum. Chapter Four of the 2020 PIB presents the fiscal framework, which is anchored on the dual tax system – corporate income tax and hydrocarbon resource tax. There is also a dynamic and flexible royalty system that is anchor on production, terrain and price to lessen the regressive effects of royalty on investment performance.

The design of the tax and royalty system portrays, in my opinion, government’s aversion to risk, and a glaring preference for early rent-seeking in the quest for enhancing government’s access to petroleum revenues. I would, rather that the government recalibrates its royalty and tax structure to deemphasise early rent extraction mechanism, and embrace a mutuality of interest approach to fiscal systems that are designed in order to achieve Pareto Optimality Conditions for all stakeholders.

Regarding fiscal terms for gas, the idea of generating revenues from gas for the next ten years must be carefully evaluated. Yes, there is a possibility of abuse, with respect to tax and royalty holidays, but an easy instrument to encourage and accelerate gas development is inevitable, and PIB 2020 must invoke such instruments. Tax and royalty holidays that are based on output seem better than incentives based on efforts. A superficial imposition of fiscal arrangements in the Bill needs clarity. If at all possible, government must avoid imposing direct contractual agreements with any lessee. Perhaps, having a specified model PSC in the Bill seems at odd within the context of the reform objectives in Section 258.

Fiscal Administration: Section 259 defines the roles of the institutions responsible for the administration of the fiscal provisions in the 2020 PIB in terms of the fiscal elements – royalty and taxes. The Federal Inland Revenue Services (FIRS) is responsible for the assessment and collection of hydrocarbon tax, and the corporate income tax, while the Petroleum Regulatory Commission (PRC) has the responsibility to determine and collect rents and royalty defined in Section 306.

There is apprehension for some regarding the transactional cost incurred for the collecting role of these institutions rather than mandating payments directly to the designated federation account. Perhaps, for the sake of transparency and governance cost minimisation, the responsibilities of these administrative institutions may be limited to just the determination of payment dues, and let the collection responsibility be executed through direct payments to the treasury with limited intermediaries.

Hydrocarbon Tax (HT): The introduction of the hydrocarbon tax mechanism or instrument in the upstream petroleum space represents a significant departure from the single tax system (the petroleum profit tax) that has prevailed in the Nigerian upstream industry since 1959. Most of the provisions in Chapter 4 describe in details the mechanism of this tax instrument. It is not an uncommon taxation approach over and above the familiar corporate income tax. In fact, it is a useful instrument to incentivise hydrocarbon investment without compromising government’s access to revenues, if needs be. To argue against its introduction, using double taxation label, is acting wily. It is also incorrect to state that PPT is being split into two. It is not only because the base for the calculation of corporate income tax is diffident, but the two tax rates are not additive. Furthermore, the allowable deductions are not the same, either.

Let me, in the following paragraphs, make some important observations on some key aspects for consideration as the process for the PIB progresses to becoming an act.

The hydrocarbon tax is applicable to liquids petroleum (oil, NGL, condensates) by terrain (onshore, shallow offshore, and deep offshore (>200m of water depth)); but not applicable to associated gas, non-associated gas. There were six classes in the original PIB, and the HT can be consolidated for each of the terrains, but no consolidation across terrains is allowed. There seems to be quite a lot of ongoing amendments post NASS public hearings. The very one amendment that agitates my mind the most is the request to not apply HT to deep offshore. I really think this is absurd, and such requests must be disallowed. I want to take a clue from the zero royalty in the PSC 1993 arrangements. I really would think it unwise to let go of an acceptable fiscal systems design principles in exchange for the new demand for royalty payments from all deep offshore production. I would rather allow HT to be deducted than to let go of it entirely in deep offshore, irrespective of whether the assets are matured or new.

Further, another amendment in consideration in this section is in reference to a periodic review of the fiscal instruments every seven years. Looking at the long-term nature of the petroleum business, seven years pronouncement in the law may create additional uncertainty that may threaten contract sanctity. Perhaps this is to create an opportunity to introduce HT back in seven years. I opine strongly that subjecting the fiscal instrument to review every seven years may be unwise. A more pragmatic approach than the specification of periodic review of the terms is to introduce a self-adjusting mechanism that could be tied to new oil bloc is that the terms have to change.

Section 266 on the deductibility of acquisition cost for HT calculation reminds me of the depletion allowance clauses in the US fiscal regimes of old. Yes, whatever is doable to make Nigeria attractive to capital investments must be pursued, but not without compromising core principles of petroleum fiscal systems and rules of engagement. Provisions design for a target group can become a problem in not too distance future. This provision, which attempts to differentiate rights from assets for tax calculation purpose, though looks good now, but might be problematic in the future.

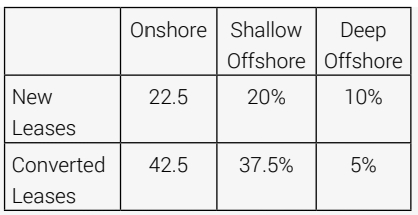

Section 267 described the HT rates (%) by terrain (frontier basins exempted until renewal) as follows:

Discussions are ongoing to consolidate the rates for converted old assets in onshore and shallow water terrains at 37.5 per cent and 20 per cent for new assets in the terrains. I commend these efforts. I am bewildered, however, at the suggestion or request to exempt deep offshore assets old or new from HT, and I alluded to this much earlier. Twice beaten, once shy. The absence of royalty in production in the PSC arrangement of 1993 beyond 1000 metres of water created some bickering among stakeholders. The suggestion to exempt deep offshore assets from HT does not make much sense more so for matured assets with no meaningful risk exposure. Could this be a back door tactic to ameliorate the Deep Offshore Act of 2019, which demands for deep offshore royalty payments? If I am to advise the government, I will advise them not to exempt deep offshore perpetually from HT with the hope to reinstate after seven years. Put the 10 per cent HT for deep offshore, and perhaps, tie it to a scale time, cumulative production, or R factor. Do not put ‘exempt the HT’ for deep offshore.

Domestic Base Price of Gas: If and when this Bill is passed, it becomes an Act, putting a base number for gas in an Act creates a perpetual market distortion and an inhibitor to gas development. Perhaps, there can be a lesson to learn from the US Natural Gas Policy Act of 1978, which specified wellhead prices for different categories of natural gas for the interstate and intrastate markets, then. This is the responsibility of the authority, in my opinion. Avoid over legislating. Section 167(c) really does not belong to the PIB.

Production Allowance: The Sixth Schedule of the PIB introduced a new concept to guide incentives tied to output. Very commendable instruments in comparison to incentives based on efforts such as investment tax allowance, uplifts and the darling of them all in the PSC 1993, the investment tax credits mechanism. However, there is something with the minimum of $2.50 per barrel and the 20 per cent of the fiscal oil price that I just cannot fathom – perhaps, the absence of sunset. The reasoning behind the absence of sunset to these incentives beats my imagination.

The production allowances for new leases are very generous – lower of 20 per cent of fiscal price per barrel or US$8 per barrel up to a designated cumulative production. Thereafter, the production allowance for projects under this Act is the lower of 20 per cent of fiscal oil price and US$4.00 per bbl. The fact that the allowance is tied to cumulative production and terrain makes the new regime progressive. I am, however, surprised that these allowances remained unchanged, even though the HT rates may change as negotiation progresses.

Cost Price Ratio: The reasonability of this instrument is not conjectural. One of the challenges of petroleum development in Nigeria is the rising cost of production. It is not that allowable deductions would not be fully recovered, but there is a limit of revenue that could be used in a period.

Royalty Rates by Volume: Usually, royalty in whatever form, is considered to be regressive by investors, because it shows the risk averseness of the government. One, however, understands why government prefers royalty to taxes. The design of the royalty schemes in PIB 2020 did attempt to reduce the regressive impact, using sliding scales tie to production and terrain as follows:

A field-by-field calculation of royalty makes a good sense, and the fact that the Commission determines the royalty payments removes any suspicion or lack of transparency. However, if I have my ways, I would suggest the reduction of the maximum royalty onshore to 15 per cent, maximum shallow water rate to 12.5 per cent, and keep deep offshore maximum to 10 per cent, but expand the cap to 50,000 for the first tranche. I may even reduce the rate to 5 per cent, but keep the HT for deep offshore. The reasoning for these recommendations is to improve the competitiveness, attractiveness, and progressiveness of fiscal regimes in Nigeria (see the charts below). In addition, royalty by price is additive to royalty by production, which further makes a regime less progressive, but the progressivity of a regime is not affected that much when tax instruments are properly applied. Of course, this my type of thinking may not be popular for rent-seeking hawks, but those in pursuit of output expansion understand that what makes fiscal regimes attractive to investors in most cases is delaying rent extraction to after profit is declared.

Royalty Rates by Price: I do not subscribe to the idea that this royalty by value provision is for the Nigerian Sovereign Investment Authority (NSIA). As I said in my last issue of the Valuechain Magazine, the constitutionality is left for the lawyers. Albeit, if this is doable for the SWA, why not do the same for the Host Community Fund? It is important to note that royalty rate by price is linearly estimated per dollar over and above $50 cap at 10 per cent when the price was $150 in 2020 real dollars. It means that at 50 real 2020 dollars, there is no royalty such that at $100, royalty by value rate is 5 per cent to be added to royalty by production, which makes the fiscal regime less progressive, if royalty by value is a line that must not be crossed.

I sincerely suggest that royalty by production be limited to a maximum rate 15 per cent onshore, 12.5 per cent shallow offshore, and 10 per cent, with production sliding scale. However, the reduction in the cap must be complemented with HT payments in all terrains. From my fiscal systems school of thought, it is better to increase the HT rates than to increase royalty rate, if output expansion is the aim of a fiscal regime reform.

Provisions on Gas Royalty and HT: While still on royalty, it is good that gas is exempted from royalty by value. I also know for a fact that ongoing negotiation would prefer to have zero royalty for gas, more so, if the gas is for domestic use. Again, I have a word of caution. Lessons from Louisiana are appropriate on how not to tie incentive to events or designated activities. It usually may come back to hunt the government. In the late 1990s, if I remember correctly, Louisiana tied severance tax cut to horizontal technology. The tax break was not meant for shale wells producing shale gas for there was no single shale gas wells envisaged. At the end, it was applied to Shale gas dwindling state revenue from severance tax. Thus, I will keep royalty on gas, but suspend the payments for a while, following after the Deepwater Royalty Relief Act in the United States. Further, I will recommend HT on gas and suspend it as well until gas propels itself in value creation. The fiscal regime must be flexible, dynamic, attractive and competitive without compromising a design principle.