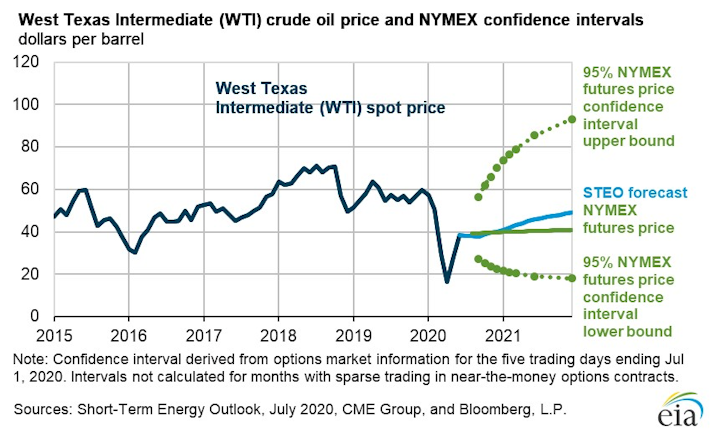

*Monthly Brent spot prices will average $41/bbl during the second half of 2020 and rise to an average of $50/bbl in 2021, the US Energy Information Administration (EIA) said in its July Short-Term Energy Outlook

Monthly Brent spot prices will average $41/bbl during the second half of 2020 and rise to an average of $50/bbl in 2021, the US Energy Information Administration (EIA) said in its July Short-Term Energy Outlook. The forecast is $4/bbl and $2/bbl higher, respectively, than its June STEO.

The forecast of rising crude oil prices reflects EIA’s expectation of declines in global oil inventories during the second half of 2020 and through 2021.

Based on the mismatch between production and consumption of liquid fuels as a result of COVID-19 and associated mitigation efforts, EIA estimates that global oil inventories increased by almost 1.3 billion bbl from the start of 2020 through the end of May.

High inventory levels and surplus crude oil production capacity will limit upward price pressures in the coming months, but as inventories decline into 2021, those upward price pressures will increase. EIA estimates global liquid fuels inventories rose at a rate of 6.7 million b/d in the first half of 2020 and expects they will decline at a rate of 3.3 million b/d in the second half of 2020 and then decline by a further 1.1 million b/d in 2021.

Global oil demand, supply

In late April, when price declines were the steepest, market participants had concerns about the ability of global storage capacity to hold the quickly rising inventory. The situation in oil markets has now shifted, EIA said.

EIA estimates that, in June, global consumption of petroleum and other liquid fuels was up 10 million b/d from April levels as economies worldwide have begun emerging from lockdown. EIA estimates global supply has fallen by 12 million b/d during the same period as a result of reduced production from OPEC+ and price-driven declines and curtailments in the US and Canada. These changes in EIA’s supply and demand estimates have shifted global oil markets from 21 million b/d of oversupply in April to inventory draws in June.

Although EIA’s forecast consumption of global liquid fuels of 101.1 million b/d in the fourth quarter of 2021 would still be less than during the same period of 2019, it would be 16.7 million b/d more than in the second quarter of 2020.

For the full year of 2020, EIA forecasts that consumption of global liquid fuels will average 92.9 million b/d, down 8.1 million b/d from 2019. EIA forecasts that both oil-consumption weighted GDP and global liquid fuels consumption will begin increasing in the third quarter of 2020 and will continue increasing through 2021.

EIA also expects global oil supply to rise in the coming quarters. However, voluntary production restraint from OPEC+ producers, along with the lingering effects of low oil prices on US tight oil production, will limit increases.

EIA estimates that non-OPEC production of petroleum and other liquid fuels fell by 5.4 million b/d in the second quarter of 2020 from the first quarter of the year. Almost 85% of these declines came from the three largest non-OPEC producers: the US, Russia, and Canada.

For 2020 as a whole, non-OPEC production will decline by 2.2 million b/d from 2019 levels, EIA forecasts. EIA expects that the second quarter marked a low point for non-OPEC production, and it will begin rising in the third quarter as oil demand increases. EIA expects production of non-OPEC petroleum and other liquid fuels to increase by 1.1 million b/d in 2021. Production in countries that have implemented voluntary cuts will generally rise in 2021 as global oil demand recovers. However, EIA forecasts production to continue to decline in US, where production is driven by price-sensitive shale operators.

EIA forecasts OPEC crude oil production will fall below 22.5 million b/d in July, a 7.9 million b/d decline from April. After July, EIA expects OPEC will continue to limit production, but to a lesser degree as cuts are relaxed, global oil demand rises, and compliance lessens.

With increases in forecast global oil demand growth in 2021, EIA assumes that OPEC members will further increase production. EIA forecasts that OPEC crude oil production will average 29.2 million b/d in 2021, up 3.2 million b/d from 2020 but about the same as 2019 levels.

EIA now forecasts that global petroleum inventory builds will average 1.7 million b/d in 2020, compared with the 2.2 million b/d inventory build EIA had forecast in the June STEO. EIA estimates that global inventories began declining in June. Forecast petroleum inventory draws average 3.3 million b/d for the second half of 2020 and 1.1 million b/d in 2021.

As a result, EIA expects that commercial crude oil and other liquid fuels inventories held within the Organization of Economic Cooperation and Development (OECD), which peaked at an estimated 3.3 billion bbl in May, will decline to 3.0 billion bbl by the end of 2020. By the end of 2021, the inventory builds that occurred in 2020 will have disappeared, and OECD commercial inventories will fall below 2.9 billion bbl, a level last seen at the end of February 2020.

US oil consumption, supply

EIA forecasts that US consumption of petroleum and other liquid fuels will average 18.9 million b/d in the second half of 2020, up from an average of 17.7 million b/d in the first half of the year. EIA forecasts that annual consumption in 2020 will average 18.3 million b/d, down 2.1 million b/d from 2019.

On a volumetric basis, almost half of the decrease in 2020 of US consumption of liquid fuels is reduced gasoline use. On a percentage basis, however, jet fuel consumption declines the most (-31%) in 2020 from 2019, followed by residual fuel oil (-20%), gasoline (-10%), and distillate (-10%). EIA forecasts US consumption of liquid fuels will recover to 19.9 million b/d in 2021.

EIA forecasts that US jet fuel consumption will decline by 540,000 b/d from 2019 to average 1.2 million b/d in 2020. Estimated consumption fell to 660,000 b/d in the second quarter of 2020, and EIA expects it to rise to 1.4 million b/d in the fourth quarter. EIA’s forecast consumption continues rising in 2021, and averages 1.5 million b/d for the year, remaining less than the 2019 consumption level of 1.7 million b/d.

U.S. motor gasoline consumption in the forecast averages 8.3 million b/d in 2020, down 1.0 million b/d (10.3%) from 2019 consumption levels. The annual declines are largely the result of travel disruptions and COVID-19 mitigation efforts that occurred predominantly in the first half of 2020. In the second half of 2020, gasoline consumption is supported by a forecast increase in employment and is expected to rise from an average of 7.8 million b/d in the first half of 2020 to 8.8 million b/d in the second half of the year. EIA assumes employment levels continue to grow in 2021, driving gasoline consumption up 800,000 b/d from 2020 levels to average 9.1 million b/d in 2021.

EIA estimates that annual US crude oil production will average 11.6 million b/d in 2020, down 600,000 b/d from 2019 as result of a decline in drilling activity and production curtailments related to low oil prices. This 2020 production decline would mark the first annual decline since 2016.

EIA expects production to decline slightly through the first half of 2021 and then to generally increase for the rest of 2021 as prices and economic conditions become more favorable for oil drilling. However, EIA’s forecast WTI prices remain lower than $50/bbl through 2021, and with an uncertain capital environment, growth could be limited. Forecast annual average US crude oil production in 2021 is 11.0 million b/d.

SOURCE: ogj.com