As Nigeria’s top presidential contenders jostle for power come 2023, there is cautious optimism that the next political dispensation would engender workable policies to move the energy sector forward, writes Gideon Osaka

The Nigerian energy industry is slowing down to hibernation mode as political activities that will ultimately shape the next policy phase take centre stage to sell their plans to the electorate and inadvertently send signals to investors.

Incumbent President Muhammadu Buhari who ran for the office of president in 2015 on the ‘Change’ mantra had promised far-reaching reforms in the sector that included raising the nation’s power supply volumes, making the oil and gas industry and Nigeria one of the world’s cutting-edge centres for clean oil and gas technology; restoring the non-performing refineries to optimum capacity; ending gas flaring, passing the Petroleum Industry Bill (PIB), making Nigeria the world’s leading exporter of LNG, ending fuel subsidy, curtailing oil theft and corruption in the sector.

The passage and signing into law of the Petroleum Industry Act (PIA) on August 16 has been one of the greatest achievements of the Buhari Administration and perhaps the most profound event in the Nigerian oil and gas space in the last 20 years setting the stage for the unprecedented transformation of the sector. Under the new Act, the NNPC has transformed into a Limited Liability Company while the regulatory framework for the sector has also changed, with the establishment of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), and the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), which merged the hitherto-existing Petroleum Products Pricing Regulatory Agency (PPPRA), Petroleum Equalization Fund (Management) Board (PEFMB), and the Midstream and Downstream Divisions of the defunct Department of Petroleum Resources (DPR).

The Buhari Administration has declared this decade the “Decade of Gas” and prior to the declaration, started the ongoing construction of the 614km Ajaokuta-Kaduna-Kano Gas Project, the largest domestic gas project in the country.

About $45million in financing has been secured from the Islamic Development Bank, for the Front-End Engineering Design (FEED) Study for the Nigeria–Morocco Gas Pipeline (NMGP) project. When completed it will be the longest offshore pipeline in the world, and the second longest pipeline in the world, running across 13 countries, 11 of them in West Africa.

The administration has also successfully completed Nigeria’s first Marginal Field Bid Round in almost 20 years, expected to raise in excess of half a billion dollars, and open up a new vista of investment in oil and gas.

Under this administration, the Financial close and signing of contract for NLNG Train 7, which will grow Nigeria’s LNG production capacity by 35 per cent, was achieved in addition to the commissioning, in December 2020, of the new NPDC Integrated Gas Handling Facility in Edo State, the largest onshore LPG plant in the country, with a processing capacity of 100 million standard cubic feet of gas daily, producing 330 tonnes of LPG, 345 tonnes of propane and 2,600 barrels of condensate, daily.

Although some remarkable achievements have been recorded despite challenging periods of oil prices plunge, Covid-19 and attendant economic recession, however, some self-inflicted challenges that have plagued the administration have been even bigger, leaving expectations by Nigerians largely unmet.

Thus, complex and multi-pronged challenges still confront the country’s energy sector ranging from low power generation, waning investments in oil and gas industry, dilapidating infrastructure, dipping oil production, opacity, insecurity of physical assets, community issues, lengthy contract cycle terms and general administrative complexities.

Nigeria remains largely dependent on sales of oil, and refines almost none of its crude, instead exporting what it produces and paying to import refined products.

Despite billions of dollars spent on power generation projects, there is still no commensurate result in terms of additional megawatts to the national grid.

Therefore unmet targets in the energy sector lay agenda for the incoming administration of the government, and players in the industry are keen on the character and predisposition of the next president of the resource-rich African nation.

Since the beginning of the year, the energy sector has taken pause to evaluate the past and cast projection into the future. In a string of conferences, workshops, lectures and seminars hosted virtually and in-person, players have engaged policy drivers in debates on action plans that would position the operating environment for greater value delivery.

The 2023 election is particularly considered strategic to the sector because it comes at a time the producers and consumers in the global energy industry are polarized between choices that command investments in meeting prevailing energy demand and strong sentiments diverting funding from the fossil energy industry toward the development of renewable options.

With global financing windows closing against fossil energy development and narrowing the available investible funds, Nigeria has also two major steps in also transitioning its energy sector towards greater efficiency and private participation.

In the past one year, the major industries in the energy sector-petroleum and electric power-have witnessed significant policy and regulatory transitions. The Petroleum Industry Act (PIA) was passed to strengthen industry regulation and reinforce the national oil company with greater financial and administrative autonomy to enhance commercial efficiency and profitability.

In the electricity supply industry, the regulator has also rolled out stronger guidelines for commercial relationships among different investor groups in the chain in order to arrest worsening debt overhang and reduce capacity redundancy in the generation segment of the industry.

It would be recalled that reforms in the domestic energy sector were conceived in 2005 with the privatization of national assets in the electric power sector, and articulation of the Petroleum Industry Bill (PIB). Implementation of both reform initiatives were bogged down by fiscal and commercial disputes between the government and private players on the best-operating terms.

Thus, with PIA rolling into effect in the oil and gas industry, and Contract Activation sparking off in the electric power sector; the Nigerian energy industry has this year stepped into a new fiscal and regulatory regime as the country resets its priorities in the face of energy transition.

The new regulatory regimes in the sector, industry analysts have noted, come at a critical time when the administration of President Muhammadu Buhari is also in transition, raising concerns in the industry over the political sentiments that would impinge on industry policies as contenders with differing ideologies scramble to seize the reins of government.

Therefore, concerns are high among stakeholders over the fate of investments in the industry as from May 29, 2023 when a new administration of the federal government is expected to come into effect.

Economic and investment analysts are focused on the energy industry due to the crucial role of the sector in supporting government revenue and domestic productivity. The petroleum industry accounts for over 80 per cent of government’s foreign exchange revenue, over 50 per cent of total funding to government budgets, about 30 percent of gross domestic product and some 90 per cent of the nation’s balance of payment.

National Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA) and similar investment groups in the domestic industrial sector point out that an efficient electric power supply industry could crash cost of production by over 60 per cent, propel efficiency to over 80 per cent, build output capacity, enhance job creation, displace significant import volumes and reduce demand on the nation’s foreign exchange reserves.

Traditionally, political parties in the country and their candidates anchor their promises on fixing the energy sector; and the electorate who demand enhanced factors of production in the domestic economy task politicians with resolving the nation’s energy quandary.

Therefore, as the election campaigns set to kick off in September, hints and snippets are beginning to drop from the three strongest contenders for the 2023 presidency. It is obvious that Nigeria is in dire need of a president that can transform the sector into an industrial lever for the economy.

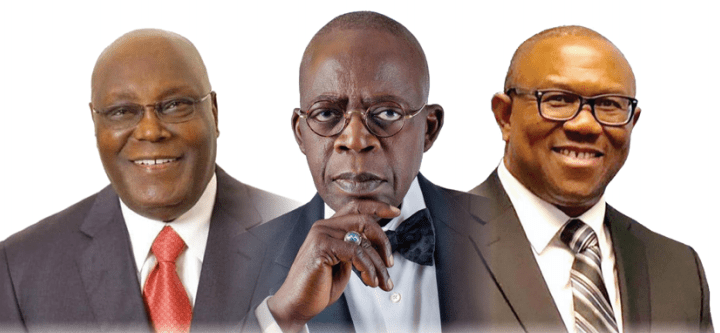

Having successfully won respective primaries and emerged as standard bearers of their political parties for the upcoming general elections, the three leading presidential candidates one of whom may likely be the next president of Nigeria – Atiku Abubakar of the People’s Democratic Party (PDP), Bola Ahmed Tinubu of the All Progressives Congress (APC) and Peter Obi of the Labour Party (LP) – already indicated their plans for the energy sector.

Although none of the presidential candidates have presented their official manifesto, apparently in wait for official campaign to begin, Valuechain has extracted and reviewed some of the promises, plans and views of the leading presidential candidates on the energyl sector.

Their intention or views were collected from statements made by the candidates during their acceptance speeches after clinching the presidential tickets of their respective parties, promises already contained in their parties’ manifesto, campaign documents publicly canvassed by the party and the candidates, opinion pieces either published by the candidates or their parties in reputable newspapers and then speeches/interviews personally delivered by the candidates during media interviews, local and international conferences.

Atiku Abubakar (People’s Democratic Party)

The presidential candidate of the PDP, Atiku Abubakar, is a consummate businessman who has played in some of the most strategic sectors of the economy. He runs a business empire that has a spread of investments in oil and gas logistics and services.

Abubakar Atiku was also Vice President of Nigeria between 1999 and 2007 during which period he chaired the National Council on Privatization (NCP) responsible for the privatization of government enterprises to allow private sector participation and curb public sector ineptitude.

As a former Customs officer and now businessman, Atiku is obviously aware and conversant with the challenges in the domestic energy sector and would have a clear sense of urgency in making the local operating environment congenial for commercial investments.

Ahead of the 2023 general election, Atiku was reported to have released a policy document tagged, ‘My Covenant with Nigerians,’ an updated version of the 2019 document in which he vowed to defeat the mafia-like structures undermining Nigeria’s energy sector.

In the run-up to the 2019 elections, Atiku’s plan to partially privatize the state oil firm then known as the Nigerian National Petroleum Corporation (NNPC) did not go well with most Nigerians, even though he proposed other far-reaching reforms like privatizing government-owned crude refineries, issue new licenses for greenfield investments in refineries and consider re-introducing bidding rounds for marginal fields and oil blocks, that were overshadowed by the NNPC sale.

The 2019 manifesto also promised to make sure Nigeria refined half of its crude output of roughly 2 million barrels per day after one year of his administration.

The new updated policy document itemized Atiku’s plans to restore Nigeria’s economy to the pre- 2015 level, summed up to a 5-point development agenda, how the economy under his watch, will be guided by three basic principles – re-affirming the criticality of private-sector leadership and greater sector participation in development; while also repositioning the public sector to focus on its core responsibility.

The PDP flag bearer proposes, just like in 2019, plans to break government monopoly in all energy infrastructure sectors including refineries.

At the centre of Atiku’s campaign is his promise to make Nigeria work again and part of his remedy is deregulation and privatization: getting the government out of the way for full-fledged capitalism that would attract billions of dollars of investment from international conglomerates.

Going by his antecedents and promises, the ongoing reforms in the petroleum industry are expected to progress to full implementation if Atiku becomes president. This hints at further cycles of privatization to whittle down government interests in energy assets, starting with the Nigerian National Petroleum Corporation (NNPC) and her refineries.

In a 2018 interview with the Africa Report, Atiku advocated privatization of NNPC. Insisting that government should reduce shareholding to enable private funds to develop its infrastructure in the sector and the economy.

Atiku believes privatization will not only free the government of needless spending, but also “clean up the infrastructure mess in the petroleum downstream sector.”

“As a nation, we are better off privatizing our refineries and the NNPC through the time-tested LNG model in which the FG owns 49 percent equity and the private sector 51 per cent.”

The Buhari Administration recently advanced the transition process for the commercialization of the NNPC with the unveiling of a new-look NNPC, which Atiku said the APC-led government bought into his plan to privatize the company.

He, however, hinted that more steps needed to be taken in order to make it more profitable, promising to complete the transition process of the privatization if he gets the mandate to serve in 2023.

The former Vice President has on several occasions canvassed for the building of a Strategic Reserve to store unsold crude. Atiku who has canvassed for this Strategic Reserve could immediately accomplish this should he be elected president in 2023.

Atiku has plans to eliminate subsidy on imported fuel and let the market determine the price, a potentially risky strategy in a country where even rumours of price hikes have triggered protests by Labour unions. In the power sector, Atiku’s presidency would likely strive to achieve generation of 25,000MW.

Bola Ahmed Tinubu (All Progressive Congress)

The National Leader of the All Progressives Congress (APC) and frontline presidential candidate in the 2023 general elections for the party, Bola Ahmed Tinubu, was the governor of Lagos State between 1999 and 2007. He has a track record of excellence when he presided over the affairs of the state, which according to his followers, it was the foundation he laid for the development of the state that made it the third largest economy in Africa.

In the document titled ‘My Vision for Nigeria’, Tinubu promised to dismantle subsidy structures and open the domestic fuel market to supply and price competition from local refineries.

Just like Atiku, Tinubu’s administration plans to establish national strategic reserves to stabilize supplies and shield the domestic market from price swings.

On electricity, Tinubu promised to build 15,000 megawatts of power generation if elected as the next president, which he says will be done through more “government borrowing” and private partnerships.

He claims to have sponsored a 90MW Independent Power Project (IPP) in Lagos State.

The Tinubu Campaign Organization said it has taken steps to come up with a broad-based manifesto that will have the inputs of all Nigerians before electioneering in September. While this broad-based manifesto is being awaited, it is very unlikely that Tinubu’s presidency will deviate or reverse some of the policies or programmes in the sector inherited from the Buhari government. Instead, Valuechain predicts that the administration will build on the following successes of the Buhari administration.

Peter Obi (Labour Party)

The candidate of LP, Peter Obi, served as governor of Anambra state between 2006 and 2014. He has promised to replicate his achievements in Anambra on a large scale in Nigeria if elected president.

Under his watch as governor, Anambra was the first State to commence Sub-Sovereign Wealth savings, the first of its kind in Sub-Saharan Africa. Also, the Nigerian Debt Management Office (DMO) rated Anambra as the least indebted state in Nigeria. In spite of visible and measurable achievements recorded in various sectors, the State under him did not borrow or raise bonds for her various projects. In addition, the Senate of the Federal Republic of Nigeria rated Anambra State as the most financially stable state in the country.

Obi’s biggest selling point is his tendency for cost-cutting and investment of state funds in commercial enterprises. He holds up the card for public-private partnership in commercial enterprises. He is never an advocate of subsidy. Obi has clearly taken a stand on removal of fuel subsidy if elected president, arguing that subsidies are not beneficial to the country’s economy.

Obi also promised 15,000 megawatts (MW) of electricity in four years, pointing at an Egyptian model with an overall target to generate over 50,000MW of electricity. The Former Anambra governor, who is popular for being frugal, may run a government built on savings from periods of oil boom.

It would be recalled that the three key presidential candidates represent a seismic shift in the profile of political leaders in the country. They are all consummate businessmen who have thriving enterprises and business and equity interests in various sectors of the economy, including energy sector.

Unlike former leaders of the country who were career civil servants, bureaucrats, and military Generals with limited private sector experience; any of Atiku, Obi or Tinubu would form Nigeria’s first businessman in the presidency.

Whereas many analysts argue that their experiences and understanding of the expectation of business players on how congenial the investment environment must be conditioned; others raise the flags of the potentials of spilling private business interests into government’s policy decisions.

However, it is expected that their business acumen would come to bear in the onerous task of transforming the nation. The expectation is driven from the time-tested premise that a successful businessman is always a good administrator of systems and manager of resources.

This means that none of the candidates might be swayed by the global sentiments for energy transition. They are expected to make the best use of Nigeria’s abundant and available energy resources while remaining competitive in the field of emerging green energy revolution.

Again, all three key candidates have the requisite experience in public sector governance systems, having been governors and vice president. Therefore assembling economic teams that will fit into their energy agenda and economic prosperity wouldn’t be a source of concern to electorates.

However, addressing the prevailing security crises in the petroleum industry would be the litmus test in steering the energy sector into efficiency. Everyone understands that one of the biggest blunders of the outgoing administration is the cancellation of facility protection contracts in the operating environment. And with the restoration of the contracts at the end of the administration, it is expected that the incoming administration would consolidate on gains of asset security in the zone to optimize industry gains.

On the global space, Nigeria’s next president is expected to hold the charisma of economic maestro who coordinates pan-African energy policy on the world stage. Therefore the presence of any of the three candidates on global policy podium is critical in promoting multilateral policies that would advance peculiar needs in the home territory.

Nigeria’s late energy diplomat and former Secretary General of the Organization of Petroleum

Exporting Countries (OPEC), Dr. Mohammad Barkindo, would obviously need a caliber A replacement at multilateral energy policy platform.

Most importantly, it is visible that all energy policies and plans espoused by the presidential candidates appear to be misaligned or trailing behind developments in the industry. There is an urgent need for them to catch up with issues in the electric power sector where concerns have since shifted from generation to supply delivery.

Solution-based discussions should shift from generation capacity building to cutting redundancies and optimizing available capacity through efficient regulation for transmission, distribution, and diversification.